Helios’ Bionic Ear Detects Market Volatility with Voice Tone

NEW YORK, December 15, 2022 - Helios Life Enterprises, today announced a revolutionary new creation: the Helios Voice Summation Index (VSI) which measures...

NEW YORK, December 15, 2022 - Helios Life Enterprises, today announced a revolutionary new creation: the Helios Voice Summation Index (VSI). Helios’ VSI is the first volatility index which measures the market’s belief in corporate communications exclusively through the tone of voice.

Imagine a world where corporate transparency is obtainable. In this world, everything from executives’ financial decisions to their personal beliefs would be open for investors to see. People would be able to trust that their leaders are making decisions in their best interest. They would know that their leaders are not only competent, but also ethical. If a leader made a misguided decision, investors would be able to quickly recognize it and demand change. And if an answer was unknown, the veil could be lifted leading to better market efficiencies for all. Greater accountability would create a feedback loop encouraging leaders to make better decisions and continually improve.

A recent Nasdaq article said of text-based analysis: “The technology once standard for autonomously analyzing company earnings and other corporate releases, predictive modeling and natural language processing of corporate text-based communications, is becoming increasingly less effective as investor relations specialists and technology providers offer solutions that allow corporates to better optimize their language to maximize the sentiment of these bots.”

Text-based analysis alone is missing 38% of the message which is found in voice tone. Helios’ VSI can help investors obtain a broader picture of the market by considering the way executives speak. Since a CEO alone can account for up to 45% of a company’s performance, understanding their tone of voice is crucial to make well-rounded investment decisions. A better understanding of a company’s c-suite is a better understanding of a company’s overall performance. Events, such as the FTX collapse, have greatly increased the need for voice tone analysis. We cannot continue to operate in a world where voice tone is not systematically incorporated into our decision-making process.

"Helios has grown from an idea that needed to be incubated, into an accelerator that the market needs now more than ever,” said Helios Co-Founder and CEO, Sean Austin. “With our latest innovation in the VSI, we are providing never-before-seen insights into the volatility of the world, security or even speakers themselves. Let's give transparency priority."

A Next-Generation Volatility Forecast

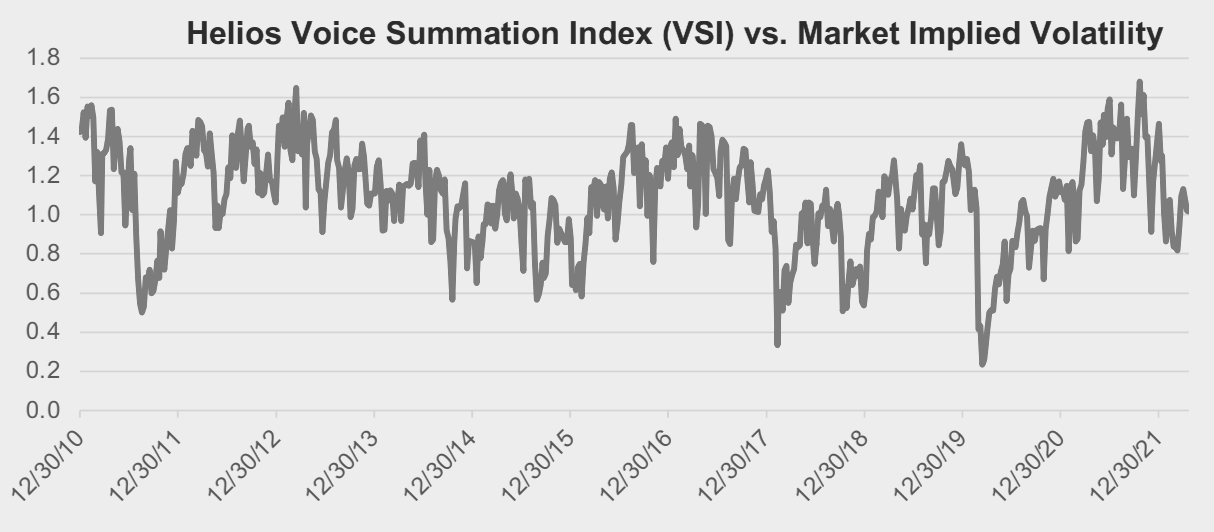

Helios' proprietary algorithm generates a daily index value which represents a forecast of the forward 30-day annualized volatility. The VSI understands the voice features of executives and anticipates the level of volatility that could result in the future just from the way executives speak. Helios’ VSI measures the executives’ uncertainty from the tone of their voices, and pools the results across all executives from all public firms that had a call on a particular day to improve results.

First adopter – Volos – analyzed the Helios VSI and derived an options-based signal to be utilized as an active parameter within their Volos’ Strategy Engine, a no-code options backtesting engine. Volos created a signal to alert investors when the ratio between the VSI and the market’s implied volatility reaches an extreme (see figure below). The signal becomes bearish when market implied volatility is widely elevated compared to Helios’ forecast. The signal becomes bullish when that trend stops persisting and the ratio begins to normalize. For more information on how Volos leverages the Helios VSI and their findings check out their recent case study.

Why Do Volatility Indices Matter?

During unstable market conditions, it is essential for traders and investors to watch volatility indices in order to understand overall market sentiment. One of the most well-known volatility indices is the CBOE Volatility Index (VIX) or the “Fear Gauge”. The VIX is known to derive its value from the options of S&P 500, indicating investors’ views on the future of the market. It is observed that VIX has a strong negative correlation with the volatility of S&P 500. When the value of VIX increases significantly it depicts that the investors and traders are expecting the markets to go down in value and vice versa.

Most recently, in 2020, the financial markets became highly unstable due to the Covid-19 pandemic. This was indicated in the CBOE-VIX which shot up from an average level of 20 to an all-time high of over 80. In the same period, the S&P 500 dropped from almost 3,400 to almost 2,200. Quite the correlation between the two indices.

The Helios VSI is a valuable addition to the toolkit of any investor or trader who wants to understand and predict market risk. By providing a leading indicator of market volatility, the Helios VSI can be used to generate trading signals that are not available from any other source.

Who benefits from volatility indices?

- The importance of volatility is even greater for quants or other short-term traders. Such firms that understand and can trade volatility directly.

- Despite working with a slightly longer time frame—typically days or weeks—swing traders’ primary focus remains market volatility. Such traders can use volatility indices to get an overview of market sentiments and plan trades accordingly for high probability of profits.

- Mutual fund managers and portfolio managers - When volatility indices indicate a rising level of market volatility, they use these indicators to move risk on or off depending on their market view, purchasing hedges (if their market return forecast is negative), or buying upside exposure (if their market return forecast is positive). Vice versa, a practitioner may sell volatility through a systematic Covered Call or PutWrite strategy, as well as purchasing high beta stocks that will have reduced volatility in a low volatility market.

Ultimately, tone of voice reveals information not registered by traditional text-based solutions such as NLP and fundamental data analysis. This new channel of data represents a generational shift where institutional investors will incorporate new forms of alternative data into their portfolios.

Contact our team to learn more about the Helios VSI and how you can incorporate tone of voice into your investment strategy.

About Helios Life Enterprises

Helios Life Enterprises (HLE) is a pioneer in voice-based tonal analysis. HLE is the first and currently only company to conceive and devise a widely available data platform that delivers systematic analytics of an executive’s voice during critical corporate events. These analytics provide novel information that is useful for predicting future earnings surprises, company performance, and cumulative abnormal returns in the context of M&A events. Core product offerings include: the Comprehend product suite for buy-side investors of all sizes and in limited pilot Mercury; a scaled research and audio analytics platform that allows a firm to extract full tonal value from their own proprietary audio.

For more information or to request a demonstration, please visit https://www.helioslife.enterprises/.

About Volos

Allocators, investment managers, and advisors use Volos’ Strategy Engine, to tailor options programs to meet their organization or end client’s investment objective. Volos’ Strategy Engine enables the design of both simple passive and sophisticated active options strategies.

Please email jeff.corrado@volossoftware.com to learn more about the Volos enterprise solution.

# # #

BUSINESS CONTACTS

Zeynep Yenisey

Director of Marketing

zeynep@helioslife.enterprises

518-212-7163